Credit debt Company Insurance plan Relative amount (DSCR) personal loans will be customized financial loans that happen to be normally employed by individuals around housing plus enterprises. All these personal loans will be slightly built so that you can prioritize a borrower’s salary in accordance with its already present credit debt repayments. DSCR personal loans will be attracting all those aiming to extend its portfolios and also cope with regular plans, as they quite simply give money based on the applicant’s net income rather then common salary documents.

Comprehension your debt Company Insurance plan Relative amount (DSCR)

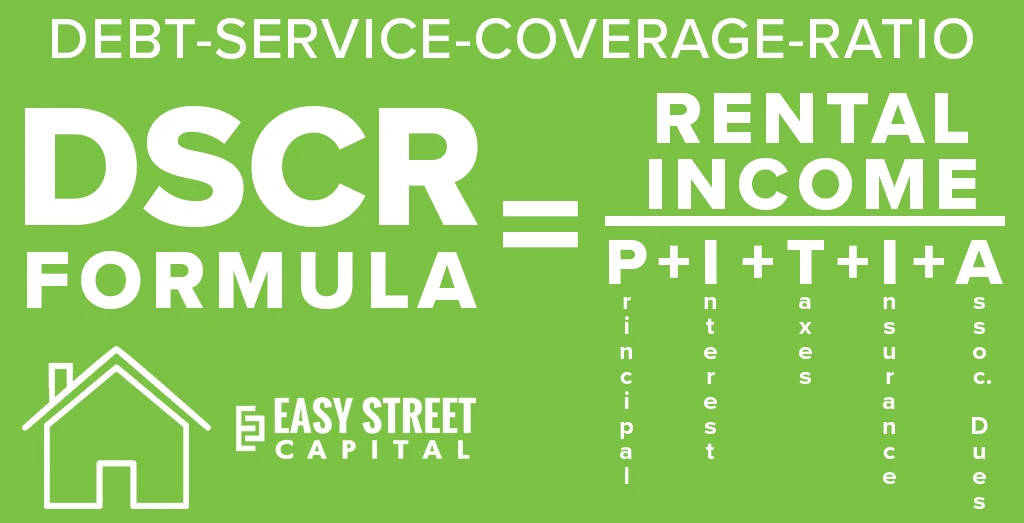

Your debt Company Insurance plan Relative amount is actually a economical metric made use of by loan merchants so that you can review your borrower’s capability reimburse credit debt. Its considered by way of separating a borrower’s goal performing salary by way of its whole credit debt repayments. The exact result, available for a relative amount, presents comprehension on the borrower’s economical overall health. By way of example, your DSCR of just one. 26 usually means the fact that lender includes 25% a higher price as compared with its credit debt wants, that is certainly ordinarily an appropriate perimeter for some loan merchants.

In the example of DSCR personal loans, loan merchants expect to have a relative amount that they are not less than 1. 0, which means a salary developed is enough to protect your debt bills. An improved DSCR relative amount frequently echoes improved economical firmness plus may bring about extra ideal financial loan stipulations. Having said that, to get people which includes a more affordable DSCR, the odds of getting qualified for your financial loan may perhaps be lower except in cases where the loan originator will accept specified mitigations or What is Dscr Loan maybe more home interest rates.

The best way DSCR Personal loans Deliver the results

Compared with common personal loans that want in depth salary documents, DSCR personal loans center on net income as being the most important determinant with eligibility. Loan merchants review your borrower’s DSCR relative amount by way of investigating economical promises plus predicted salary. The following flexibleness added benefits self-employed people today plus housing individuals who seem to won’t currently have dependable per month salary nonetheless conduct yield major net income.

DSCR personal loans are sometimes in real estate investment, as they quite simply allow for people so that you can make use of a lease salary from them homes so that you can be considered. Your money pass out of all these homes will help these folks exhibit an adequate DSCR, this enables the theifs to funding supplemental investment funds. All these personal loans as well give ambitious home interest rates, as they quite simply position less probability to get loan merchants as a consequence of center on net income rather then recruitment track record and also very own salary.

Greatest things about DSCR Personal loans

Flexibleness around Degree

DSCR personal loans offer an different with regard to by using non-traditional salary methods, building these folks attainable so that you can business men plus housing individuals.

A reduced amount of Documents Important

Considering all these personal loans trust in net income rather then salary documents, people call for a lower number of contracts wants, streamlining a application for the loan approach.

Prospects for Bigger Financial loan Figures

People by using great DSCR ratios could are eligble for large financial loan figures, permitting them to funding sizeable investment funds and also large-scale plans.

Please Individuals

DSCR personal loans will be mainly valuable to get asset individuals, as they quite simply is able to use lease salary so that you can be considered plus most likely extend its portfolios.

Threats Involving DSCR Personal loans

When DSCR personal loans give appreciable added benefits, they can be never without the need of threats. People by using fluctuating salary concentrations will find them tricky to hold a DSCR relative amount for the duration of global financial downturns. On top of that, for the reason that all these personal loans center on net income, there will be tension for people to hold continual lease and also business enterprise salary. Your short lived downfall around salary make a difference to a DSCR relative amount, most likely creating challenges around financial loan repayment demands.

Who seem to Should be thinking about your DSCR Financial loan?

DSCR personal loans will be right to get housing individuals, self-employed people today, plus people who run businesses. The following financial loan style is good for individuals that yield major net income out of investment funds nonetheless won’t currently have classic recruitment salary. People around all these areas normally believe that it is tricky so that you can are eligble for common personal loans resulting from fluctuating salary fields, building DSCR personal loans an appealing method.

Individuals wanting to extend its housing holdings and also funding massive plans normally trust in DSCR personal loans. All these personal loans enable them so that you can make use of its present-day net income so that you can safe and sound money without the need of in depth salary documents. To get people who run businesses who seem to prioritize advancement, DSCR personal loans have a bendable resolution this aligns utilizing their hard cash flow-centric economical styles.

Final result

To sum it up, DSCR personal loans absolutely are a priceless resource to get people who seem to yield dependable net income out of investment funds and also enterprises. By way of being focused on your debt company insurance plan relative amount, loan merchants measure the borrower’s capability cope with credit debt by salary rather then classic recruitment documents. By using bendable degree important factors plus a lower number of documents wants, DSCR personal loans will be a reasonable method to get housing individuals plus self-employed people today.

When DSCR personal loans give famous added benefits, people consist of threats, primarily around fluctuating salary problems. For any by using continual lease salary and also dependable net income, having said that, all these personal loans produce a simple plus powerful money resolution.